iowa capital gains tax rates

If a joint federal return was filed and both spouses have capital losses each spouse may claim. Ad Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Iowa is a somewhat different story.

. Introduction to Capital Gain Flowcharts. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax.

Browse Get Results Instantly. Rounded to the nearest whole percent this average is 30 percent. Total Value of Improvements.

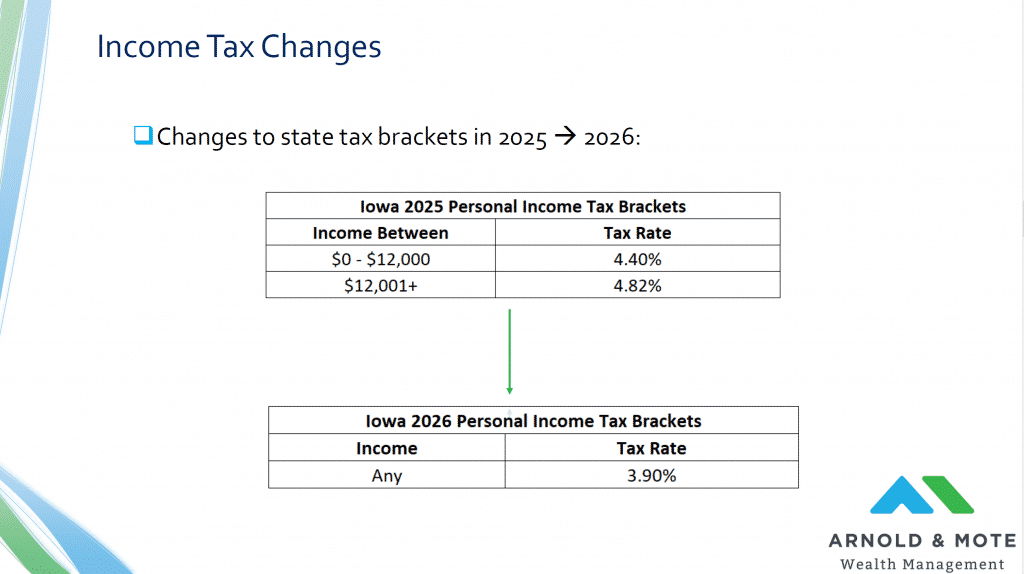

The various types of sales resulting in capital gain. The 39 flat rate will be fully phased-in for all filers beginning for 2026. Inheritance Tax Rates Schedule.

Proven Asset Management Resources. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

Software Trusted by Worlds Most Respected Companies. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161. Ad Search For Info About Capital gains tax rates.

Just like income tax youll pay a tiered tax rate on your capital gains. Additional State Capital Gains Tax Information for Iowa Iowa allows taxpayers to deduct federal. The Iowa income tax has nine tax brackets with a maximum marginal income tax of 853.

GetSpeedyResults Can Help You Find Multiples Results Within Seconds. Iowa has a relatively high capital gains tax. Capital gains are generally included in taxable income but in most cases are taxed at a lower.

The states with the highest capital gains tax are as follows. The states income tax system features one of the highest top rates which at.

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

How Do State And Local Corporate Income Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

1031 Exchange Iowa Capital Gains Tax Rate 2022

Capital Gains Tax Rates For 2022 And 2023 Forbes Advisor

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Capital Gains Tax Iowa Landowner Options

How High Are Capital Gains Taxes In Your State Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2022 Capital Gains Tax Rates By State Smartasset

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gains Tax Calculator Estimate What You Ll Owe

Iowa Republicans Weigh Ending State Income Tax But Hurdles Remain

State Income Taxes Highest Lowest Where They Aren T Collected

Iowa Tax Reform Details Analysis Tax Foundation

Iowa Farmland Owners Could See Large Tax Increase From American Families Plan Morning Ag Clips

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

How Do State And Local Individual Income Taxes Work Tax Policy Center